Changing the Phase of Creator Payouts Using A2A Payments

As a business owner, would you ever consider paying your employees with your corporate credit or debit card?

At Kahana, we had to ask that fundamental question as we move towards building a more creator-centric platform. This inquiry led us to explore alternative payment methods that could better serve our hub creators and their financial needs.

Fundamentally, Kahana is a place where people come to build a knowledge base and get paid fairly for their work. As a company, we want Kahana to be a place that is dependable and uses best practices in the industry. While we are a platform that lets individuals and organizations host their digital work, we also need to be mindful of how they receive payouts.

Before delving into the article, let's clarify two key terms used throughout:

Understanding the terms "Creators" and "Customers" will provide context for the article.

The Challenge with Traditional Payment Methods

As digital platforms scale, they process an increasing volume of transactions through debit and credit card payments. These payment methods, while convenient for customers, come with inherent complexities and costs that affect both the platform and its creators.

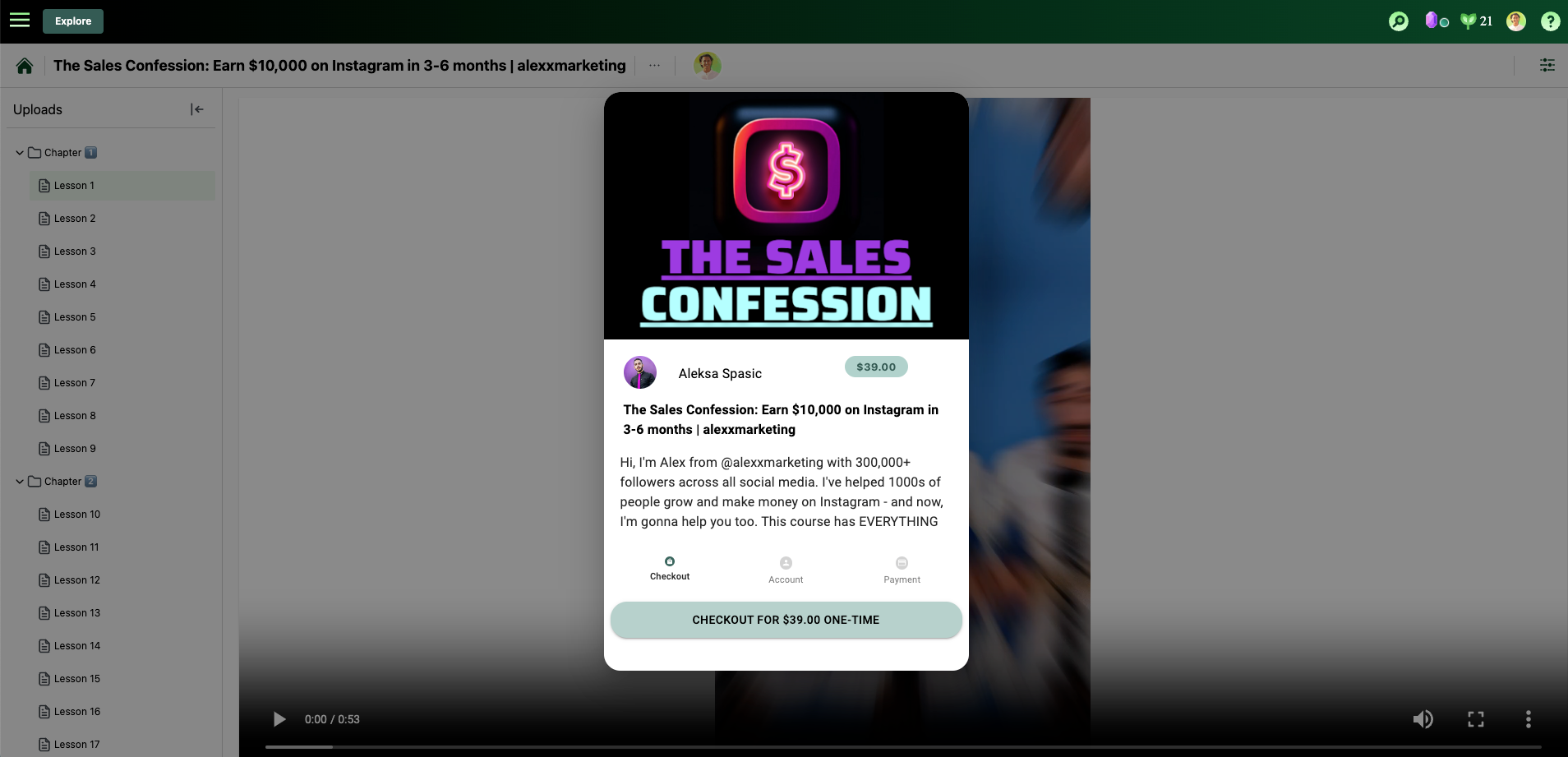

For a customer (anybody shopping for digital products online, people looking for high-quality resources), paying for content is extremely simple. You enter your card details and hit the checkout button, However, for hub creators, this transaction is important to understand, as it directly impacts the final amount which ends up in their bank account.

The current payment process utilizing our Stripe checkout page operates as follows:

A more detailed breakdown from Stripe:

The typical 2.9% + $0.30 fee structure on Stripe encompasses both the payment processor's charge and the card network's cost. To better understand these fees, it's helpful to examine the processing fees for major card networks individually. These fees vary depending on the specific network and card type, generally ranging from 1.15% to 3.30%, plus $0.05 to $0.10 per transaction for most credit cards including American Express, Visa, Mastercard, and Discover. It's worth noting that consumers don't see these fees added separately to their purchases, as they're typically incorporated into the retail price of goods and services, both in-store and online.

While these fees might seem insignificant to the average customer, they can have a substantial impact on creators who are building alternative income streams through online platforms. For these individuals, not only the amount but also the speed of accessing their earnings is crucial. Traditional payment processors often require 7-14 days for payouts, and this timeline doesn't account for potential delays caused by credit card disputes or chargebacks.

Account-to-Account (A2A) payments offer an alternative that can benefit individual creators and organizations. By choosing A2A payments when available, customers can support creators by enabling faster and more reliable access to their earnings. For those who don't have a strong preference between A2A and credit cards, opting for A2A can significantly impact creators' cash flow positively. As a result, many platforms are exploring A2A payment options to create a more efficient system that benefits both creators and buyers.

The Impact on Creators

For creators selling products on online platforms, various payment methods can impact their business in different ways:

- Revenue considerations: Different payment methods may have varying transaction fees. These fees can affect the net income creators receive from their sales, which is an important factor for those managing tight profit margins.

- Cash flow management: The timing of payouts can vary depending on the payment method used. Some methods result in faster access to funds, while others may have longer processing times. This timing can influence how creators manage their finances, especially if the platform is a significant source of their income.

- Income predictability: Various payment methods come with different levels of finality. For instance, some methods may be subject to disputes or chargebacks. While these processes are important for consumer protection, they can create uncertainty in a creator's income flow. It's worth noting that chargebacks and disputes are not inherently negative - they're a necessary part of a fair marketplace. However, their potential occurrence is a factor creators may need to consider when planning their finances.

This impact also translates to small businesses and larger organizations that are using these online platforms as a way of revenue.

Introducing Account-to-Account Payments (A2A) as a Payment Option

To address these challenges and better serve our community of creators, we're exploring Account-to-Account (A2A) payments as an option on Kahana. A2A payments offer several advantages:

- Instant payouts: A2A payments can significantly improve cash flow for creators by reducing the time it takes for funds to reach their accounts.

- Lower fees: A2A transactions typically come with lower processing fees compared to credit and debit card transactions, allowing creators to keep more of what they earn.

- Enhanced security: A2A payments leverage bank-level security measures, providing peace of mind for both creators and their supporters.

- Broader accessibility: A2A payments can be an option for users who may not have access to credit cards, potentially expanding creators' audience reach.

Here is an example of how A2A payments work in this case, taking similar variables from the Stripe checkout illustration above:

It is also important to know that lower fees in transactions would help creators pass on the savings to the consumers. Ideally, A2A payment providers would charge a flat rate of $0.40-$0.50 per transaction which is extremely low compared to the card networks. The final amount that the hub owner is paid using the A2A payment method is significantly higher than using the traditional payment methods.

While this plays heavily in the favor of creators selling products, there are some drawbacks to using the A2A payment method instead of traditional methods for buyers:

- Fraud Protection: Card networks provide robust fraud protection services for consumers using their cards across various platforms. This built-in security feature offers peace of mind to many users.

- Rewards Programs: While some A2A providers like Waivr offer cashback incentives, credit card reward programs remain a significant draw for many consumers. These programs, which may include points, miles, or cashback, continue to be a strong motivator for credit card usage in transactions.

- Financial Flexibility: Credit cards essentially function as short-term credit lines for consumers. Users can make purchases with borrowed funds, which are then repaid to the credit card company at a later date. This system operates independently from the user's bank account balance until payment is due. In contrast, A2A transfers deduct funds directly from the user's bank account at the time of the transaction. The success of an A2A transfer is contingent on the available balance in the linked bank account, whereas credit card transactions can proceed regardless of the user's current bank balance.

The Future of Creator Payments

By implementing A2A payments, we will be taking a significant step towards creating a more creator-friendly financial ecosystem on Kahana. This move aligns with our commitment to fairness and transparency, ensuring that creators can focus on what they do best – creating valuable content.

As we continue to evolve and grow, we'll keep exploring innovative payment solutions that benefit our creator community. Our goal is to make Kahana not just a platform for sharing knowledge, but also a reliable source of income for creators who contribute their expertise and creativity.

The shift towards A2A payments represents more than just a change in transaction methods – it's a fundamental reimagining of how creators can be compensated fairly and efficiently in the digital age. We're excited about the possibilities this opens up for our community and look forward to seeing how it empowers creators to thrive on Kahana.

Jumpstart your digital products business

Kahana is a collaborative platform and marketplace for individuals, teams, and organizations to sell digital products.

Talk with a Kahana representative

Fill out your information and a Kahana team representative will reach out to you. Have a simple question? Search our library of articles